Accounts Receivable AR: Definition, Uses, and Examples

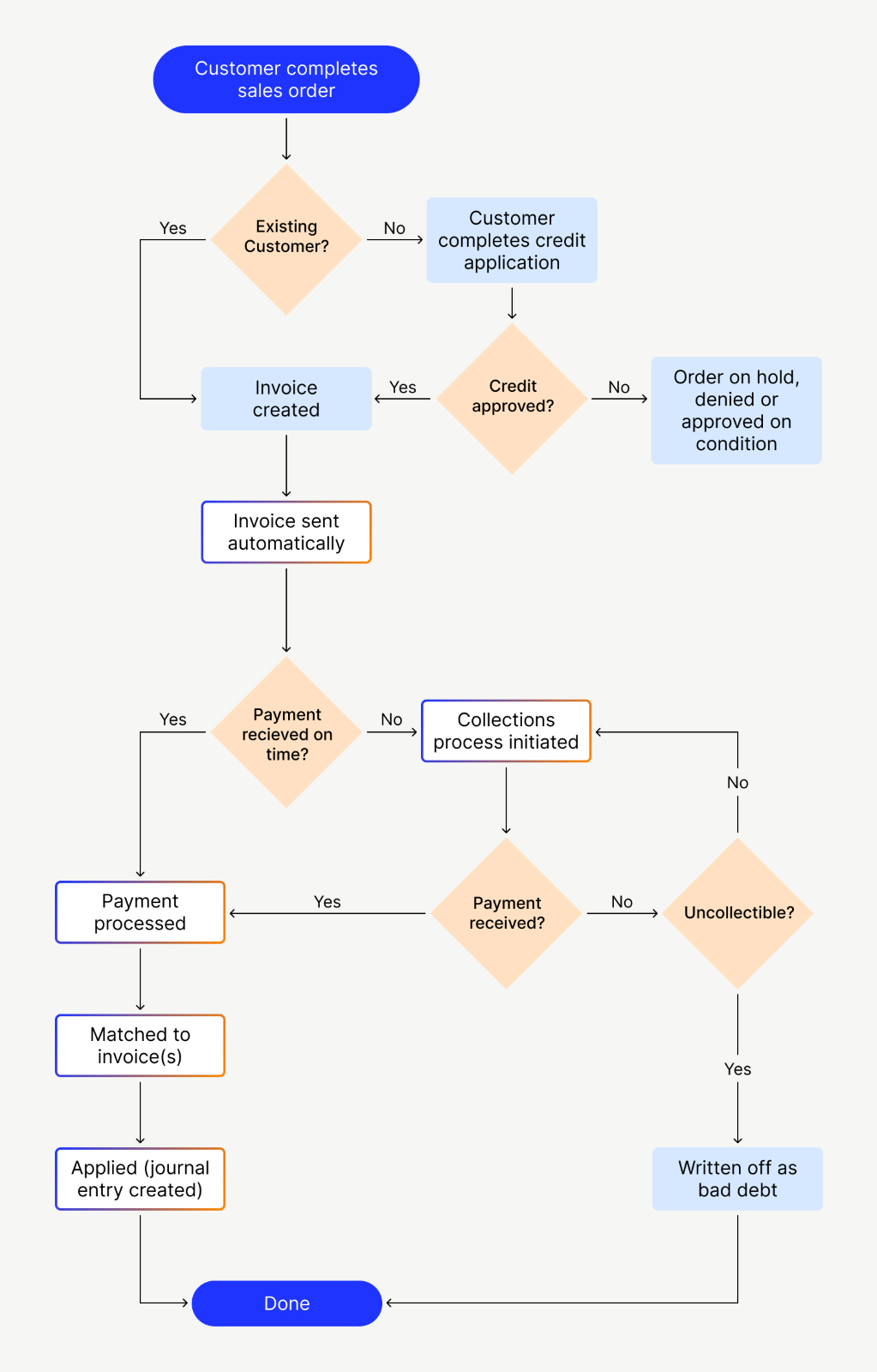

Automating aspects of your accounts receivable—such as invoicing and late payment reminders—frees up time and energy to focus on other aspects of your business. Cash reconciliation, or effective record-keeping, is important for generating accurate financial records and ensuring all payments are resolved. Promptly recording all transactions makes it easier to track any unpaid invoices and keep all financial records up to date. In cases where all attempts at collection management fail, a business may have no choice but to write off the bad debt. It’s helpful to have an established timeline for when your company considers unpaid invoices to become bad debt. The Accounts Receivable process is the set of steps a business follows to invoice a client and collect payment.

Step 7: Resolve Disputes

The hot tub company would invoice her and allow her 30 days to pay off her debt. During that time, the company would record 6 3 receivables intermediate financial accounting 1 $5,000 in their accounts receivable. When Jane pays it off, the money would go back to the sales amounts or cash flow.

The Accounts Receivable Aging

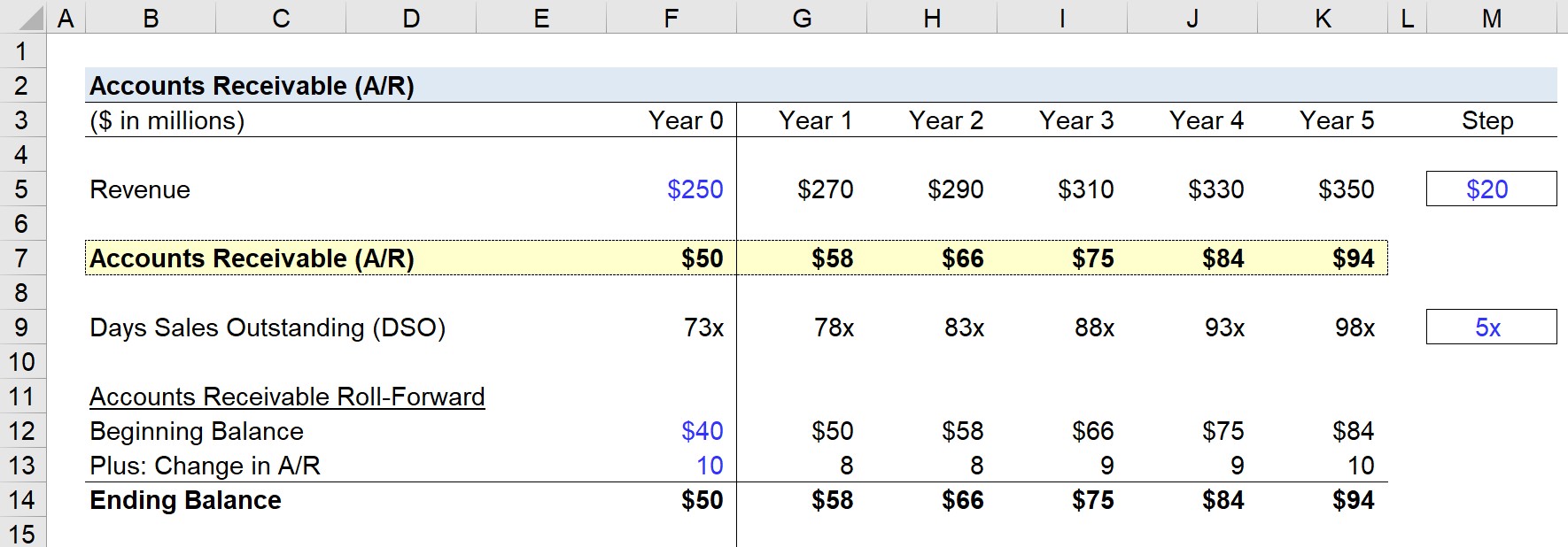

While the revenue has technically been earned under accrual accounting, the customers have delayed paying in cash, so the amount sits as accounts receivables on the balance sheet. A low DSO means that customers are paying promptly after receiving their invoices and that your team is quickly processing the payments. This correlates to good cash flow and lower amounts of bad debt write-offs. For most of these methods, businesses will need a merchant account and in many cases a payment processor.

- The process includes a series of steps, starting from the sale and ending with accounting for AR in your books (and hopefully receiving payments from customers).

- As a business owner, you undertake numerous transactions on credit, meaning you purchase as well as sell goods on credit.

- In this journal entry, both total assets on the balance sheet and total revenues on the income statement increase by $200 on July 10.

- Net accounts receivable is the total amount that your customers are liable to pay, after accounting for any doubtful payments, and is collected from these customers.

What Is Accounts Receivable (AR)?

It reflects the money owed to a company from the sale of its goods or services that remains to be paid by the buyer. Even though it is not yet in hand, it is considered an asset because the company expects to receive it in due course. The shorter the period of time a company has accounts receivable balances, the better, as it means the company can use that money for other business purposes. Accounts receivable is deemed an asset because it is an outstanding balance that you are yet to receive from your customers. Accordingly, this unpaid balance in the accounts receivable account forms part of the current assets section on your company’s balance sheet. On a business’s balance sheet, Accounts Receivable is recorded as a current asset.

Accounts Receivables Administrator

But when you can do more with less, you can better recoup some of that outstanding debt with a lower overhead of time, energy, and capital. So, you need to set aside some amount of money as an allowance for any doubtful accounts. This allowance is subtracted from the gross receivables of your business to determine the net realizable value of accounts receivables. The allowance for doubtful accounts is the estimate of accounts receivable not expected to be paid by the customers for goods sold on credit to them.

Accounts receivable turnover ratio

Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Automating your Accounts Receivable increases accuracy and efficiency, saving your business time and money while improving the customer experience. This helps assess the efficacy of your Accounts Receivable process and provides an overview of your revenues for the month.

But, how do you know which software is the best choice for your business? Having a solid accounts receivable collection process allows your business to bring in cash before invoices are past due or become bad debts. In turn, this helps your cash flow stay healthy and boosts business profitability and growth. Unfortunately, not all of your customers will pay their debts promptly, meaning you’ll likely have to do some chasing to recover those outstanding funds.

This credit balance will cause the amount of accounts receivable reported on the balance sheet to be reduced. Any adjustment to the Allowance account will also affect Uncollectible Accounts Expense, which is reported on the income statement. The allowance for doubtful accounts is also recorded as a contra account with accounts receivable on your company’s balance sheet. Liquidity is defined as the ability to generate sufficient current assets to pay current liabilities, such as accounts payable and payroll liabilities.

After a business collects payments, it’s time to generate financial reports and analyze the data you’ve collected. Regularly reviewing these reports helps ensure that all outstanding invoices are accounted for and that no unpaid debts have gone missing. When you have a system to manage your working capital, you can stay ahead of issues like these. Calculating your business’s accounts receivable turnover ratio is one of the best ways to keep track of late payments and make sure they aren’t getting out of hand.